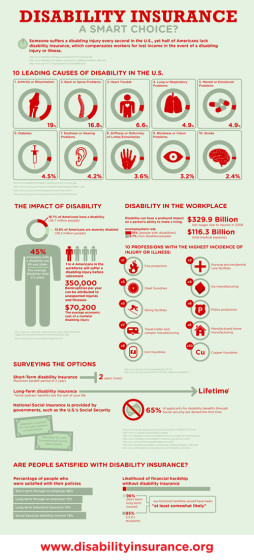

No one wants to think about suffering a terrible injury, being unable to work, or providing for your family. While you may not want to think about it the reality is accidents can and do happen to anyone, at any time. When dealing with minor injuries, medical insurance usually covers the expenses associated with doctor visits and related expenses.

However, when a person is severely injured, they will likely be unable to work and may have expenses other than their medical bills to worry about. This is an unfortunate circumstance that can seriously affect a family where only one parent is the breadwinner.

Having disability insurance will provide a much-needed safety net in the event of an unforeseen accident.

Here are five reasons disability insurance is important for families:

1. Disability Insurance Provides An Emergency Income In the Event You Cannot Work

When the unexpected happens and you are a victim of severe injury it’s at a time when bills and other major life expenses are due. Disability insurance provides an emergency income allowing you to pay your most pressing bills without worrying about additional fees.

2. A Lack Of Pressure On Financial Issues Allows For A Less-Stressful Experience

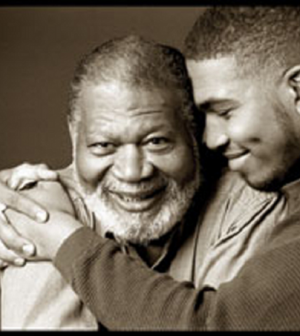

When you are recovering from a major injury, you and your family are likely focused on your struggles related to your health and well-being. Recovering from an injury can be a long and painful process needing your family’s help. Recovery goes much more smoothly and productively when you are not also worrying about how to take care of your basic financial needs. Disability insurance helps you simply focus on getting better.

3. Your Family Will Have the Stability Needed to Get Back On Its Feet

A major injury in the family often means the family must regroup and find a way to continue functioning and meet basic needs. Disability insurance gives your family the chance to maintain a sense of stability as they work to find new income sources and take care of important life experiences.

4. Keep A Roof Over Your Head

One of the most important expenses you pay every month is probably your mortgage payment or rent. What would happen if you were suddenly unable to make these payments? You and your family’s stability could be seriously jeopardized if you suddenly lost the place you all call home. Disability insurance can help make sure you retain this important centerpiece of the family as you recover.

5. The Basic Necessities Will Be Covered

If you have children and/or other family members who depend on you for food and shelter, their well-being may be jeopardized in the event you are no longer able to provide these important necessities for them. Disability insurance is a way of making sure those who rely on you will have the basic things they need for their well-being, no matter what happens to you.

Jeffrey R. Lamb, an Associate Lawyer at Martin Stanley Law, is a devoted husband and in his off time donates his time speaking about Education and the Law.