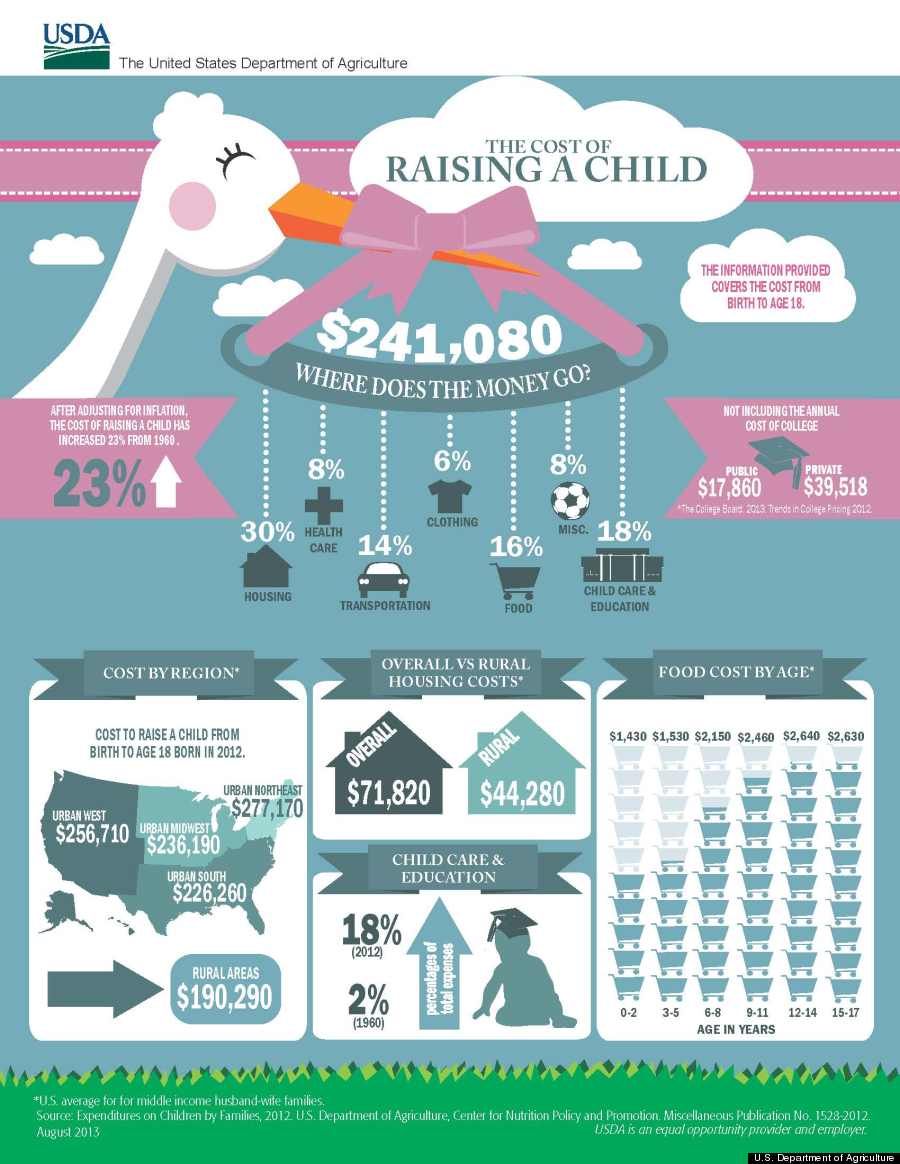

From the first doctor’s appointment until high school graduation, the US Department of Agriculture reported in 2013 it costs approximately $241,080 for a middle class family to raise a child. Many don’t consider the costs a child brings. But if you consider them, you can make a budget so you don’t get into financial trouble before your child even makes it to kindergarten. The following describes the specific costs parents will incur during the journey:

Preparing For Baby

The First Five Years

The primary costs during the first five years include housing, formula, food, diapers, and childcare. Housing is the largest cost, making up almost one third of all expenses. Childcare, food, and transportation are the following three most expensive items. These three, however, will fluctuate, depending on the age of the child. The average costs for diapers, formula, and other baby food average about $2,500 a year.

Once a baby is eating regular food, the cost will average between $1,000 and $2,000 annually until the child is in school. While breastfeeding and using cloth diapers may not work for everyone, it will definitely save money during the first few years. Childcare is also a huge expense, averaging $10,000 a year for infants. Those who are able may want to decide if working part-time or working from home is more cost efficient.

The School Years

Once a child starts school, food expenses will begin to dramatically increase. While housing and transportation costs remain steady throughout the first 18 years, most other items will fluctuate. Costs for clothing and miscellaneous items, such as being on sports teams or taking music lessons, will likely increase during the school years. A child’s health will affect how much is spent on doctor and dental visits during this time. Even with good insurance, co-pays and deductibles add up quickly.

While raising a child may seem financially overwhelming, planning and sticking to a budget before the baby arrives will help ease costs. It’s wise to start a college fund as early as possible since these estimates don’t include college. While it is good to be prepared for these expenditures, you also need to realize unexpected costs will come up from time to time, and that is just part of being a parent—it’s actually just a part of life.

Although they come at a high price, the journey of having children is so rewarding that you shouldn’t put it off because you are worried about spending money. If you can budget and save, you will be able to support your child, and enjoy the priceless experience of being a parent.

Information for this article was provided by the financial experts of checks-superstore.com.