Making sure your family is protected financially is top priority in any circumstance. Many people have the skill to effectively manage their finances, while others are not very good at it.

What if you needed the money for something important? Perhaps, a family holiday or you need to save up money to send one of your own to college?

Scrimping and saving can be a real hassle and can often be stressful at times as you wonder what to cut back on. Whether you are a single parent or a couple living on a low income, there is always a way to save up enough money to help relieve the stress as the month progresses. Here are some tips on how to manage your money to help benefit your family:

Create a Budget

First and foremost, in any money management situation, developing a budget is important. This will aid in keeping an eye on spending and seeing where your money is going. At the start of the month, write down all your expected income for the month in one column.

In the second column, write down your fixed expenses, for example, direct debits, mortgages, utilities, etc. In the third column, write down the variable expenses such as shopping and travel. The idea of the budget is to make sure your expenses are less than your income and to fix the variable spending by identifying where you can save costs.

Prepare for the Unexpected

Events happen that we cannot account for, especially when it comes to finances. There will often be times when we are left strapped for cash with no emergency funds. It is advised you save a bit of money each week or each month for use in the event of an emergency.

Short term loans are another option when money becomes a bit tight. You can decide on how much to borrow and you can come to an agreement with regards to how long you will need it and to pay back. Short term loans should be a last resort and it is advised not to use them to repay debts as this could lead to a vicious cycle.

Take Advantage of Free Opportunities

Why spend money on something you can do for free? If you need to take your family out for the day, avoid spending money on expensive theme park tickets. Some museums and art galleries are now free to get into.

Your wallet will thank you for it and your children will come away learning something new. Coupons are also an extremely handy item to save money. Coupons can be used for anything from saving money on groceries to getting cheaper theme park tickets (If the museum is far too boring.)

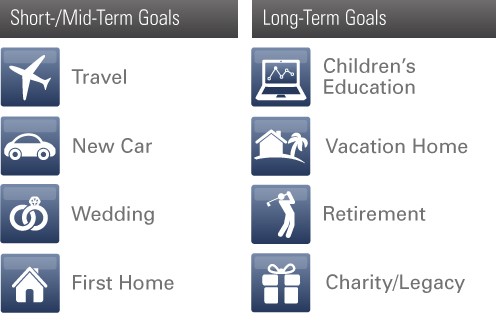

Set a Clear Financial Goal

Budgeting will help with this. Depending on what you wish to do, i.e. redecorate the kids bedroom, go on a family holiday, save up for college, set a realistic goal that will encourage you to save some money. They only need to be written down once. They become real and accountable when they’re documented.

Managing money is always an extremely tough chore and it can be straining, especially when you have a low income. Follow some of the tips above may help you in sustaining a stable financial status and if in doubt, financial advisers are always on hand to offer advice.