Estate Plan – Five Essentials for the Blended Family

Combining two families into one brings plenty of challenges. As the family learns to live harmoniously and recognize each other as kin, parents may believe they have no reason to worry about their family’s future. This peace of mind may only last as long as both parents are able-bodied and healthy. However, when one of the parents of the family grows frail and approaches his or her death, that individual may regret not having a plan in place that can head off conflicts and break apart their family unit.

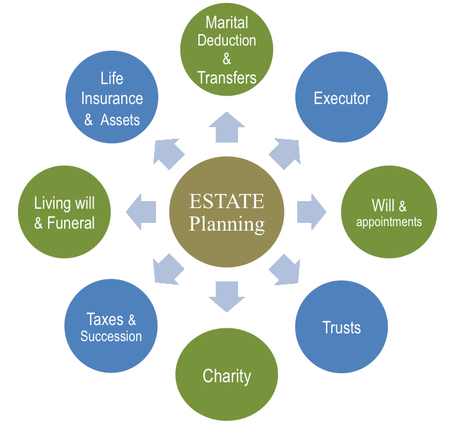

When they wonder what actions they can take to prevent their family from breaking apart after their deaths, people are encouraged to consider the benefits of an estate plan.

The plan can also appoint a person to assume power of attorney. When an elderly loved one can no longer make his or her own medical decisions, the person’s power of attorney can take over making necessary decisions regarding the loved one’s care.

This power of attorney can also be invoked when the person passes away and his or her final arrangements need to be addressed.

2) Living Arrangements

An estate plan can actually go into effect well before a person dies. When a person reaches a point in his or her life where that individual can no longer live alone, that person’s estate plan can stipulate whether or not they can be placed in an assisted living or nursing home facility. The plan can indicate which facility that person should be moved to and what belongings they want to bring along during the move.

When this kind of detailed planning is taking place it is best to be sure that a quality facility, whether assisted living or nursing home, is appointed. This research for quality living should be done well in advance and in place before the actual event. Doing an online search directly in the area you seek a facility can be very beneficial during the planning stage.

For example, do an online inquiry by inputting “Stockbridge assisted living” if the facility is for assisted living in Stockbridge, GA. Navigating online through each facility can determine all kinds of factors, including the planning for the financial arrangements to pay for such facilities.

3) Final Arrangements

When a parent in a blended family passes on, old rivalries may be reborn as both sides of the family take sides against each other. The parent’s biological children may not want their step-siblings to have any say in the parent’s final services.

An estate plan can spell out precisely the kind of funeral that person wants and who can have a say in how those services are arranged. The plan ideally will curb any buried resentments between a set of step-siblings.

4) Division of Assets

When a parent dies, siblings in a blended family may be at odds over how the parent’s assets will be divided. One person in the family may feel like he or she should have access to the assets over others.

An estate plan can divide any money, life insurance, stocks, and other assets among members of a blended family. This plan may not be contestable, particularly if it is filed and executed by an attorney.

5) Property Planning

An estate plan can report how property of that parent should be dealt with after he dies. If that person leaves behind a car and a house, that person’s children and stepchildren may fight over who gets to assume ownership of that property. The estate plan can say whether or not the home and car should be sold or if not, who should assume possession of this property.

Parents of a blended family may work hard to combine their two families into a single, happy unit. When they want to head off any worries and fights after their deaths, they can ensure their family’s happiness by devising an estate plan.

Lisa Coleman shares some important things that should be taken into consideration and how estate planning is a good choice to prevent future difficulties, particularly when involving a blended family. She recently helped assist a friend make plans for a family loved one. She researched online and read how Dogwood Forest, a Stockbridge assisted living community located in GA, personally helps with the financial planning when declined health demands moving to such a place.

Please rate this post using the Stars and Thumbs below.