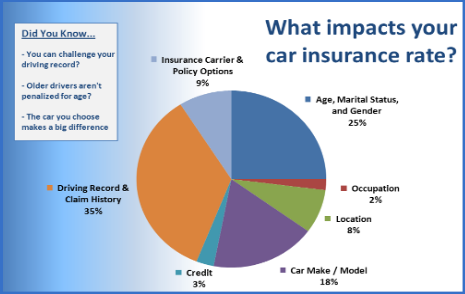

Your teenager is counting the days til they get their driver’s license. You don’t want to be surprised by your next insurance bill. It’s important for you to understand how this is going to impact your insurance rate.

Oh, be sure to remember you are legally required to disclose the fact your teen has a license to your insurance company.

Even if you live in a no-fault state like Florida, you must list your teen as a named driver on your policy if they will be using your vehicle. Also, if they are going to be the vehicle’s primary driver, you need to make sure they are listed as such to be in compliance with the insurance laws.

How Will this Impact My Rate?

To be sure, adding your teen driver to your policy is definitely going to increase your rate. There are many ways you can minimize the impact of making this change. For example, you may decide to increase your deductible to keep your rate at a more reasonable price. You should also inquire whether or not your insurance provider offers discounts your teenager is eligible for such as the reduced price that is often offered to good students.

Keep in mind many providers will offer you a better rate if your teen driver completes additional driver’s education classes. You can also get a better price by letting your teen use your oldest vehicle. Ultimately, the exact price increase will be based around all of these factors, so you should work closely with your insurance agent to get the best possible deal.

What is the Impact of an Accident?

A single vehicle accident involving teenagers in Orlando, Florida occurred on July 17, 2011, causing one fatality and three injuries. If something like this happens to your teen driver, it is important to know how this will impact your insurance rate. Many people in correctly believe that living in a no-fault state or being deemed not at fault in an accident can help protect them from dealing with a large price increase.

Unfortunately, this is not the case,

any driver who is involved in an accident that requires the insurance company to pay for anything should expect their premium to go up.

The exact amount of the increase is likely to be based around the total amount of damage and the severity of the incident. After all, a minor fender bender will require much less financial assistance than a catastrophic accident, and your insurance company should respond accordingly when they set your new rate.

The driver in the previously mentioned automobile accident or any other traffic incident that causes injuries or major vehicle damage should definitely retain an experienced local auto accident attorney. For example, an Orlando car accident attorneys firm would be the perfect fit in this scenario.

It is important to take this step because it will enable a driver who was injured by someone else’s negligence to take legal action against the responsible party so that they can recover all of their related expenses. Additionally, winning a lawsuit against the other driver can help verify who was actually at fault. Although this will not prevent your insurance rate from increasing, it could have an impact on your new premium.

Lisa Coleman shares the financial impact adding a teen driver can make to a parent’s auto insurance policy, especially if they have an accident. She recently read online how an Orlando, FL car accident attorneys group can make a difference in such a claim.

Photo Credit: http://www.flickr.com/photos/40567541@N08/9734370374/