Why You Need An Emergency Fund

As parents we have a responsibility to be prepared for life’s curveballs. Yet how many of us have emergency funds?

For many reasons, you may have abandoned your efforts to save some money for unexpected situations.

An emergency fund is money you keep away securely in a bank account or safe deposit box. When an unexpected financial need arises, there will be no panic.

The usual urgency of the situation requires emergency funds to be always readily available. Many parents who have adopted having emergency funds have confirmed it has saved lives and helped them spend less on many occasions.

Who needs Emergency Funds?

Every parent should have an emergency fund. Single parents should also strongly consider having this type of savings.

A couple can have separate emergency funds or a joint one. In the lives of parents, there are so many unpredictable events that can suddenly require money.

With your savings, you can handle such situations better.

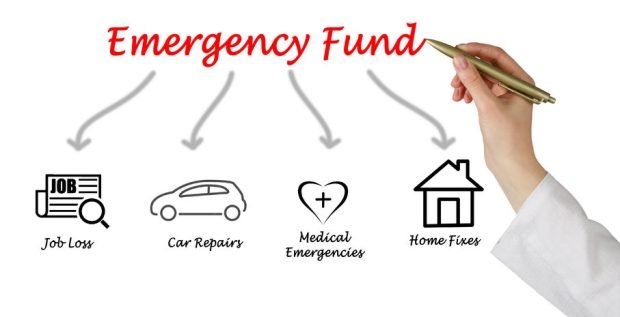

Situations that may Require you to Break the “Piggy Bank”

Every day is a blessing. Daily we need to be grateful for our lives.

Some days that start typically can suddenly turn “sour.” You’ll need to make quick decisions to prevent the issue from escalating.

Emergency funds will be helpful in situations such as

- A child or spouse suddenly falls ill

- Disasters such as fire, flooding or tornadoes that can render your family temporarily homeless

- Unplanned car repairs

- Loss of a job

- Legal issues, etc.

In these situations, you’ll have better and more options when you have readily available emergency funds.

How much Emergency Funds do you Need?

The amount of emergency funds depends on many circumstances. However, it’s best you keep enough money aside that can sustain you and your family for up to two months.

How to Build an Emergency Fund as a Parent

Many parents hold the opinion that saving is quite tricky. There may be challenges, but it is possible to save when you are committed to your plan.

The following tips will help you build a solid savings:

Set a Target for your Savings

You can decide to save a percentage of your income every month. For example, if you know your expenses on food for a month, plant to start keeping a part of your income to reach an amount that can sustain your family for two months.

Save in a High-Interest Account

Take advantage of banks offering high interest on savings. However, make sure you can withdraw your savings on a moment’s notice.

Start a Side Business

If you have a side business, you can save the profits. Your regular job can provide the funds to meet your family’s daily needs.

How Big is Your Family?

The target you set for your emergency fund should be enough to support your family.

Are you encouraged? Start making plans to save money today.

As a parent, you can sleep better knowing your family will not suffer if something unexpected happens. Here are seven steps to solid financial planning for your family.