Five Things To Get In Order Before Retirement

The day is finally approaching. After years upon years of school, work and more work, it’s all about to come to an end; retirement is nigh, and Hawaii awaits! But, before you start packing your Hawaiian shirts, ukulele and leis, there are a few things you need to prepare for.

Mostly, it’s just minor paperwork; however, there are some major steps you need to take to make absolute sure your retirement goes as smoothly as possible. So, without further ado, here are the most important things you need to look into leading up to your retirement.

1. Decide Where you are Going to Live

I’ve already jokingly described Hawaii as a go-to location for retirees, but do you actually know where you’re going to live after retirement? Chances are, you probably have your mortgage paid off, so will you stay where you are?

I’ve already jokingly described Hawaii as a go-to location for retirees, but do you actually know where you’re going to live after retirement? Chances are, you probably have your mortgage paid off, so will you stay where you are?

Sell the house and move? And, if you do move, where will you move to?

Do you have enough money to move somewhere nice? All these questions need to be answered, and preferably before the big day comes.

2. Review your Finances

This is one of those “boring paperwork” items I alluded to, but it still needs to be done. You need, and we cannot overstate this whatsoever, to know if you can afford to live as you do now after you retire.

Granted, you probably have a 401k, and you probably have some life savings that will keep you going for quite a while – perhaps at a higher pay bracket than you do now—but, if this is not the case, it’s time to start budgeting, sell your house (or refinance it), and get your spending figured out.

After all, if you plan on living out the rest of your life with no work whatsoever, you’re going to need every penny you can get! Just keep this in mind during the days leading up to your retirement.

There are a lot of great things about retirement, but a loss of income is not one of them. The good news is if you need more financial stability in retirement, there’s a loan called a reverse mortgage that can help.

A standard mortgage requires you to pay it back fairly quickly, but a reverse loan option pays you over an extended period of time without the same repayment requirement. When you leave the home the loan balance will be owed, but until then you can continue to own your home.

In fact, you must do so as part of the loan terms. The lender will use a reverse mortgage calculator to determine the maximum amount you can borrow. You can spend the money you receive on anything you want. With no extra regular mortgage bill to pay, your financial struggle will be relieved, not increased.

3. Select how your Pension and Retirement are Distributed

Getting your pension and retirement money is a big day; but, choosing how that money is distributed can have significant implications on the rest of your financial career. So, make sure you know your options, and make sure you end up choosing what is best for you and your future!

Other than that, be aware of how the process is carried out, the timelines associated with the process, and what your options are for retirement plan assets. This is all information that can save you a lot of grief later on down the line.

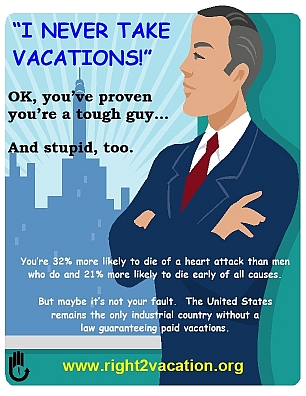

4. Use Up your Vacation Days

This one may seem a little bit chippy, but you were promised vacation days and you do have a right to use them. Unfortunately, you may end up losing them if you retire before planning it out.

This one may seem a little bit chippy, but you were promised vacation days and you do have a right to use them. Unfortunately, you may end up losing them if you retire before planning it out.

So, start planning your retirement six months ahead of time, and start using those vacation days up as much as possible! You’ll get a little extra time to start relaxing, and you won’t lose an important part of your worker’s compensation.

5. Be Professional when you Leave

When the day finally comes, it’s important that you are truly professional on your way out. You never know what’s going to happen down the road and, if you do end up having to go back to work, you need to have those personal connections.

If you don’t, there’s less of a chance of you getting a job—particularly if you want to work for your old company—and it might wind up hurting you in the long run. Just remember to treat your retirement as if you were leaving any job; give plenty of warning, and don’t step on any toes! You’ll be much better for it if you do, even if you don’t ever end up working for that company again.

The author Amy Mower used to work as a financial planner and has a passion for helping people make important life decisions, particularly those affecting their retirement. She’s writing on behalf of Dallas Retirement Village, a retirement village in Oregon that helps seniors build a happier retirement.

What are your plans when you retire? Let’s us know the who, what, where and when in the Comments. Thank you.